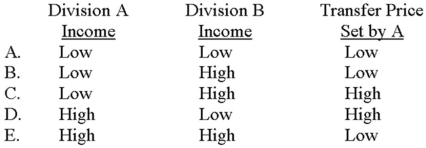

Division A transfers a profitable subassembly to Division B, where it is assembled into a final product. A is located in a European country that has a high tax rate; B is located in an Asian country that has a low tax rate. Ideally, (1) what type of before-tax income should each division report from the transfer and (2) what type of transfer price should Division A set for the subassembly?

Definitions:

Market Price

The going rate at which a particular market offers to buy or sell an asset or service.

Average Revenue

The revenue earned per unit of output sold; calculated by dividing the total revenue by the number of units sold.

Total Revenue

The total amount of money received by a firm from selling its goods or services.

Total Cost

The complete amount of money required for the production of a given level of output, including both fixed and variable costs.

Q2: Coastal Corporation, which uses throughput costing,

Q43: Odonell Corporation estimates that its variable manufacturing

Q47: The Gingham Company's budgeted income statement

Q49: The following data relate to product no.

Q50: Madison produces bicycles in a highly competitive

Q65: A trade-off in a decision situation sometimes

Q69: A recent income statement of Suni

Q70: Lasley Corporation is considering the acquisition of

Q76: If the target profit is $60,000 for

Q77: Discounted-cash-flow analysis focuses primarily on:<br>A) the stability