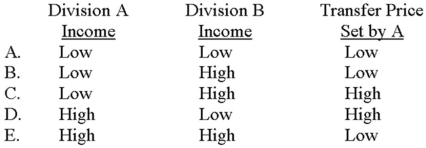

Division A transfers a profitable subassembly to Division B, where it is assembled into a final product. A is located in a European country that has a high tax rate; B is located in an Asian country that has a low tax rate. Ideally, (1) what type of before-tax income should each division report from the transfer and (2) what type of transfer price should Division A set for the subassembly?

Definitions:

Output

The amount of goods or services produced by a firm, industry, or economy.

Substitutes For Leadership

Factors in the work setting that direct work efforts without the involvement of a leader.

Work Setting

The physical and social environment in which individuals perform their job duties.

People Involved

Refers to the individuals or groups participating in or affected by a particular activity, process, or decision.

Q8: Dexter, Inc. manufactures various lines of computer

Q26: The comprehensive set of budgets that serves

Q32: Depreciation is often described as a "tax

Q48: The Dopler Manufacturing Company has two

Q52: Wagner Furniture manufactures easy-to-assemble wooden furniture

Q62: Fester Company is considering whether to sell

Q63: Deborah Lewis, general manager of the Northwest

Q65: Which of the following statements regarding price

Q70: The four tasks that follow take place

Q73: A cash flow measured in real dollars:<br>A)