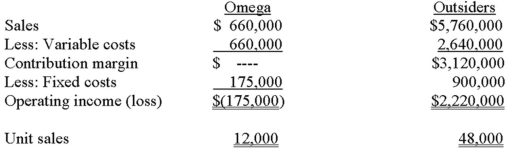

Gamma Division of Vaughn Corporation produces electric motors, 20% of which are sold to Vaughan's Omega Division and 80% to outside customers. Vaughn treats its divisions as profit centers and allows division managers to choose whether to sell to or buy from internal divisions. Corporate policy requires that all interdivisional sales and purchases be transferred at variable cost. Gamma Division's estimated sales and standard cost data for the year ended December 31, based on a capacity of 60,000 units, are as follows:

Gamma has an opportunity to sell the 12,000 units shown above to an outside customer at $80 per unit. Omega can purchase the units it needs from an outside supplier for $92 each.

Required:

A. Assuming that Gamma desires to maximize operating income, should it take on the new customer and discontinue sales to Omega? Why? (Note: Answer this question from Gamma's perspective.)

B. Assume that Vaughn allows division managers to negotiate transfer prices. The managers agreed on a tentative price of $80 per unit, to be reduced by an equal sharing of the additional Gamma income that results from the sale to Omega of 12,000 motors at $80 per unit. On the basis of this information, compute the company's new transfer price.

Definitions:

Bitter Resentment

Intense and persistent feelings of anger and ill-will towards someone or something perceived as having wronged one.

African Americans

A racial or ethnic group in the United States with ancestors who are predominantly from Sub-Saharan Africa.

Macro-Level

Pertaining to large-scale social processes, structures, or systems that affect groups, communities, or societies as a whole.

Changing Gender Roles

The evolving expectations and behaviors considered appropriate for men and women, reflecting shifts in societal norms, values, and opportunities.

Q21: Consider the five items that follow, which

Q25: The rule for project acceptance under the

Q27: When allocating joint costs, Weinberg calculates the

Q34: Prudence Corporation manufactures two products: X

Q48: The Dopler Manufacturing Company has two

Q51: The Razooks Company, which manufactures office

Q52: Snyder, Inc., which has excess capacity,

Q71: Which of the following choices correctly indicates

Q82: Cortez Enterprises is studying the addition of

Q87: Papa Friedo's Pizza store no. 16