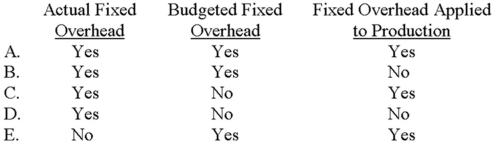

Which of the following is used in the computation of the fixed overhead budget variance?

Definitions:

AGI Limitation

Refers to the limits placed on certain tax benefits or deductions that are based on the taxpayer's Adjusted Gross Income (AGI), restricting eligibility or the extent of benefits based on AGI.

Reimbursed

Reimbursed refers to the act of repaying someone for expenses they have incurred, often related to their employment or agreed upon activities.

Qualified

A term indicating that an individual, account, or investment meets the criteria set by relevant regulations or laws, often for tax purposes or eligibility for certain benefits.

Beverly Hills

A city located in Los Angeles County, California, known for its luxury properties, shopping, and as a residence for many Hollywood celebrities.

Q10: Narchie sells a single product for $50.

Q16: Common costs are charged to a company's

Q49: The following information relates to the Cliff

Q54: Consider the following statements about the accounting

Q55: Consider the following statements about pricing:<br>I. Prices

Q63: Atlanta Enterprises incurred $828,000 of fixed overhead

Q63: Which of the following is least likely

Q69: The variable-overhead spending and efficiency variances are:

Q81: The following data pertain to Lomax

Q88: The high-low method and least-squares regression are