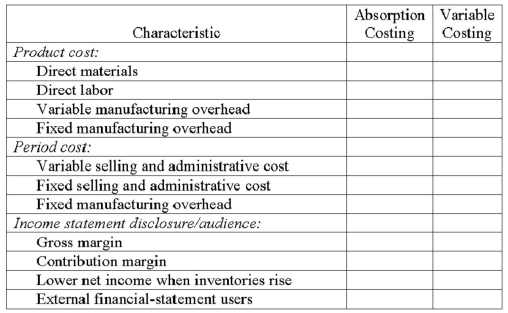

The table that follows denotes selected characteristics of absorption costing and/or variable costing.

Changes to grid above:

Lower income when inventories rise (NOT "net" income)

External financial statement USE (NOT "users")

Required:

Evaluate each product-cost, period-cost, and income-statement/disclosure characteristic and determine whether it relates to absorption costing, variable costing, or both methods. Place an "X" in the proper column.

Definitions:

Asset Management

The process of developing, operating, maintaining, and selling assets in a cost-effective manner.

Debt Management

The process of strategizing to reduce or pay off outstanding debts.

Profitability

A metric or concept that measures the ability of a company or business to generate income relative to its revenue, assets, or shareholders' equity, typically expressed as a percentage.

Debt to Stockholders' Equity Ratio

A financial metric that shows the balance between the debt and equity shareholders have employed to fund a company's assets.

Q12: Pumpkin Enterprises began operations on January 1,

Q55: A company's sales margin:<br>A) must, by definition,

Q55: Kel-Leigh Corporation, with operations throughout the country,

Q55: Quattro began operations in April of this

Q60: Briefly describe the stages used in the

Q61: From a cost behavior perspective, what type

Q69: Which of the following performance measures is(are)

Q71: Wesley Enterprises has determined that three variables

Q79: Tiara Company has the following historical

Q83: When 5,000 units are produced variable costs