Dancer Corporation, which uses a job-costing system, had two jobs in process at the start of 20x1: job no. 59 ($95,000) and job no. 60 ($39,500). The following information is available:

• The company applies manufacturing overhead on the basis of machine hours. Budgeted overhead and machine activity for the year were anticipated to be $720,000 and 20,000 hours, respectively.

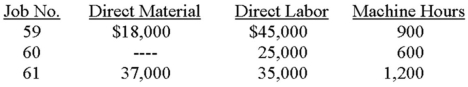

• The company worked on three jobs during the first quarter. Direct materials used, direct labor incurred, and machine hours consumed were:

• Manufacturing overhead during the first quarter included charges for depreciation ($20,000), indirect labor ($50,000), indirect materials used ($4,000), and other factory costs ($108,700).

• Dancer completed job no. 59 and job no. 60. Job no. 59 was sold for cash, producing a gross profit of $24,600 for the firm.

Required:

A. Determine the company's predetermined overhead application rate.

B. Prepare journal entries as of March 31 to record the following. (Note: Use summary entries where appropriate by combining individual job data.)

1. The issuance of direct material to production, and the direct labor incurred.

2. The manufacturing overhead incurred during the quarter.

3. The application of manufacturing overhead to production.

4. The completion of job no. 59 and no. 60.

5. The sale of job no. 59.

Definitions:

Unrestricted Contribution

Donations or funds given to an organization without any conditions or limitations on their use.

Unrestricted Resources

Funds or resources received by an organization that are not subject to stipulations on their use by donors, allowing for flexibility in allocation.

Restricted Resources

Funds or resources that are designated for specific purposes by donors, grantors, or regulatory authorities, limiting their use.

Capital Assets

Long-term assets acquired for use in a business, intended for the purpose of earning income and not for resale.

Q10: Jaune Company uses a standard cost system

Q16: You are a sports agent who is

Q20: The division's return on investment (ROI) is

Q24: Standard costs greatly increase the complexity of

Q33: Fixed manufacturing overhead is not inventoried under

Q37: Briefly define and discuss the terms in

Q44: The accounting records of Dolphin Company

Q56: What was the variable overhead rate variance

Q61: Define the term "cost driver" and discuss

Q104: What was the fixed manufacturing overhead volume