ADF provides consulting services and uses a job-order system to accumulate the cost of client projects. Traceable costs are charged directly to individual clients; in contrast, other costs incurred by ADF, but not identifiable with specific clients, are charged to jobs by using a predetermined overhead application rate. Clients are billed for directly chargeable costs, overhead, and a markup.

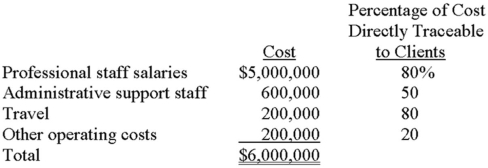

ADF anticipates the following costs for the upcoming year:

ADF's partners desire to make a $480,000 profit for the firm and plan to add a percentage markup on total cost to achieve that figure.

On May 14, ADF completed work on a project for Lawrence Manufacturing. The following costs were incurred: professional staff salaries, $68,000; administrative support staff, $8,900; travel, $10,500; and other operating costs, $2,600.

Required:

A. Determine ADF's total traceable costs for the upcoming year and the firm's total anticipated overhead.

B. Calculate the predetermined overhead rate. The rate is based on total costs traceable to client jobs.

C. What percentage of total cost will ADF add to each job to achieve its profit target?

D. Determine the total cost of the Lawrence Manufacturing project. How much would Lawrence be billed for services performed?

Definitions:

Invisible Hand

A term coined by Adam Smith to describe the self-regulating behavior of the marketplace.

Market Prices

The current value at which goods or services can be bought or sold in an open market.

Market Prices

The current price at which an asset or service can be bought or sold, determined by supply and demand in an open market.

Entrepreneurs

Individuals who start, manage, and assume the risks of a business or enterprise, often introducing innovations or exploring new market opportunities.

Q8: The provisions of sections 302 and 404

Q14: Assume that the Milk Chocolate Division is

Q15: If the amount of effort and attention

Q19: The sum of the discount factors applicable

Q33: Which of the following entities would most

Q37: The primary difference between normalized and actual

Q55: How much overhead was applied to products

Q67: A review of Parrish Corporation's accounting records

Q83: The volume variance for July is:<br>A)$1,131 F<br>B)$900

Q86: A balanced scorecard should contain every performance