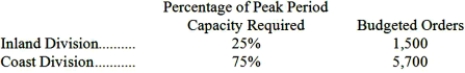

Scuderi Corporation has two operating divisions-an Inland Division and a Coast Division. The company's Customer Service Department provides services to both divisions. The variable costs of the Customer Service Department are budgeted at $29 per order. The Customer Service Department's fixed costs are budgeted at $381,600 for the year. The fixed costs of the Customer Service Department are determined based on the peak period orders.  At the end of the year, actual Customer Service Department variable costs totaled $219,905 and fixed costs totaled $383,860. The Inland Division had a total of 1,520 orders and the Coast Division had a total of 5,690 orders for the year.

At the end of the year, actual Customer Service Department variable costs totaled $219,905 and fixed costs totaled $383,860. The Inland Division had a total of 1,520 orders and the Coast Division had a total of 5,690 orders for the year.

Required:

a. Prepare a report showing how much of the Customer Service Department's costs should be charged to each of the operating divisions at the end of the year.

b. How much of the actual Customer Service Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

Definitions:

Q8: Suppose that Division A has ample idle

Q15: Koski manufactures products J and K, applying

Q18: The chief managerial and financial accountant of

Q18: The main idea behind the time value

Q35: The variable overhead rate variance for July

Q66: Which of the following would not be

Q79: Glass Industries reported the following data for

Q80: Simone uses a predetermined overhead application rate

Q93: Scarfo Hotel bases its budgets on guest-days.

Q131: The direct materials quantity variance for May