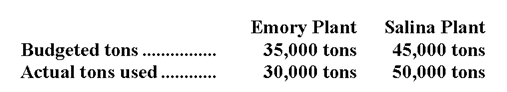

The Juab Company has a Freight Department that delivers scrap metal from salvage yards to its two fabricating facilities--the Emory Plant and the Salina Plant. Operating data for the two plants for last year follow:  Budgeted costs consist of $150,000 fixed costs and $0.50 variable cost for each ton of scrap delivered to the plants. Actual costs incurred in the Freight Department were $52,800 variable, and $165,000 fixed. Juab allocates variable and fixed service department costs separately. The level of budgeted fixed costs is determined by peak-period needs. The Emory Plant requires 40% of the peak-period capacity and the Salina Plant requires 60%.

Budgeted costs consist of $150,000 fixed costs and $0.50 variable cost for each ton of scrap delivered to the plants. Actual costs incurred in the Freight Department were $52,800 variable, and $165,000 fixed. Juab allocates variable and fixed service department costs separately. The level of budgeted fixed costs is determined by peak-period needs. The Emory Plant requires 40% of the peak-period capacity and the Salina Plant requires 60%.

-How much variable Freight Department costs should be charged to the Salina Plant at the end of the year for performance evaluation purposes?

Definitions:

In-Process R&D

Refers to the costs associated with research and development activities that are ongoing at the time of an acquisition.

Intangible Asset

An asset that lacks physical substance but is identifiable and provides economic benefits to its owner, such as trademarks, patents, copyrights, and goodwill.

Goodwill

An intangible asset that represents the excess of the purchase price over the fair value of an acquired company's net assets.

Q4: The materials price variance for May is:<br>A)$11,880

Q7: At a recent professional meeting, two controllers

Q15: Koski manufactures products J and K, applying

Q17: Which of the following is not an

Q18: Vanguilder combines all manufacturing overhead into a

Q21: The labor rate variance for February is:<br>A)$825

Q59: The fixed costs per unit are $10

Q68: A materials price variance is favorable if

Q72: The division's margin is closest to:<br>A)26.4%<br>B)10.0%<br>C)2.4%<br>D)24.0%

Q92: The materials quantity variance for September was:<br>A)$2,460