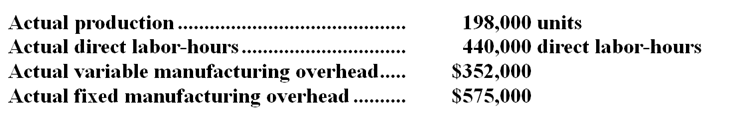

Franklin Glass Works uses a standard cost system in which manufacturing overhead is applied on the basis of standard direct labor-hours. Each unit requires two standard hours of direct labor for completion. The denominator activity for the year was based on budgeted production of 200,000 units. Total overhead was budgeted at $900,000 for the year, and the fixed manufacturing overhead rate was $1.50 per direct labor-hour. The actual data pertaining to the manufacturing overhead for the year are presented below:

-The standard hours allowed for actual production for the year total:

Definitions:

Gross Method

Accounting treatment for purchase discounts where discounts are not considered until actually taken.

Note Payable

A promissory note from the maker’s point of view.

Interest Accrued

The accumulation of interest on a loan or bond that has been earned but not yet paid.

Periodic Inventory Method

An inventory accounting method where physical counts are used to determine the cost of goods sold and ending inventory at specific intervals.

Q4: Your Uncle Otto has struck it rich

Q5: Cost management systems tend to focus on

Q5: At the economic order quantity:<br>A) total annual

Q21: The variable costs of service departments should

Q40: Rubyor Corporation bases its predetermined overhead rate

Q61: Given the following information, what is the

Q102: Franklin's variable overhead efficiency variance for the

Q153: The following data for November have been

Q264: Thomasson Air uses two measures of activity,

Q274: The overall revenue and spending variance (i.e.,