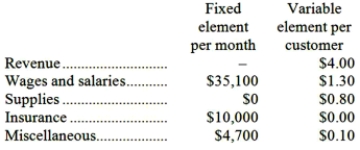

Galligan Corporation bases its budgets on the activity measure customers served. During July, the company planned to serve 30,000 customers. The company has provided the following data concerning the formulas it uses in its budgeting:  The company has also furnished its income statement for July:

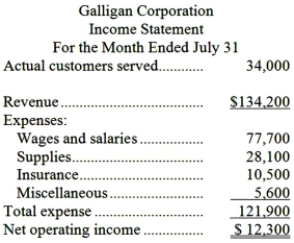

The company has also furnished its income statement for July:  Required:

Required:

Prepare a report showing the company's activity variances for July. Indicate in each case whether the variance is favorable (F) or unfavorable (U).

Definitions:

Present Value

The current worth of a future sum of money or stream of cash flows given a specified rate of return, reflecting the time value of money.

Annuity

A fiscal instrument that provides a stable flow of funds to an individual, often employed as a means of financial support for retired individuals.

Extraordinary Loss

A loss resulting from events that are both unusual and infrequent, often reported separately on financial statements.

Capitalized

The process of recording a cost or expense on the balance sheet for the purposes of delaying full recognition of the expense over time through depreciation or amortization.

Q11: If the budgeted direct labor time for

Q23: Mccoo Inc. bases its manufacturing overhead budget

Q46: The materials quantity variance for June is:<br>A)$392

Q49: If Meacham decides to purchase the subcomponent

Q99: If the budgeted direct labor time for

Q129: The materials price variance for April is:<br>A)$7,872

Q133: The occupancy expenses in the flexible budget

Q167: Lafountaine Manufacturing Corporation has a standard cost

Q221: The total fixed cost at the activity

Q274: The overall revenue and spending variance (i.e.,