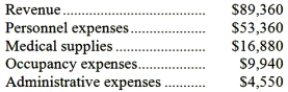

Tsui Clinic uses patient-visits as its measure of activity. During November, the clinic budgeted for 3,400 patient-visits, but its actual level of activity was 2,900 patient-visits. The clinic bases its budgets on the following information: Revenue should be $30.00 per patient-visit. Personnel expenses should be $30,200 per month plus $7.70 per patient-visit. Medical supplies should be $1,600 per month plus $5.20 per patient-visit. Occupancy expenses should be $7,400 per month plus $1.00 per patient-visit. Administrative expenses should be $3,900 per month plus $0.20 per patient-visit. The clinic reported the following actual results for November:  Required:

Required:

Prepare the clinic's flexible budget performance report for November. Label each variance as favorable (F) or unfavorable (U).

Definitions:

Opportunity Cost

The lost potential gain from other alternatives when one option is chosen.

Interest Rate

The percentage of a loan amount charged by a lender to a borrower for the use of assets, typically expressed as an annual percentage.

Miller-Orr Model

A financial model used for managing cash flows and cash reserves, focusing on maintaining balances within certain limits at minimum cost.

Upper Limit

The maximum value or level that is allowed or attainable in a given situation.

Q6: If a cost object such as a

Q52: The administrative expenses in the planning budget

Q57: (Ignore income taxes in this problem.) Charley

Q82: Bahr Corporation has provided the following data

Q86: To attain its desired ending cash balance

Q119: (Ignore income taxes in this problem.) A

Q144: (Ignore income taxes in this problem.) Janes,

Q201: The administrative expenses in the planning budget

Q267: The selling and administrative expenses in the

Q287: The net operating income in the planning