Wohner Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During August, the company budgeted for 5,000 units, but its actual level of activity was 5,050 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for August:

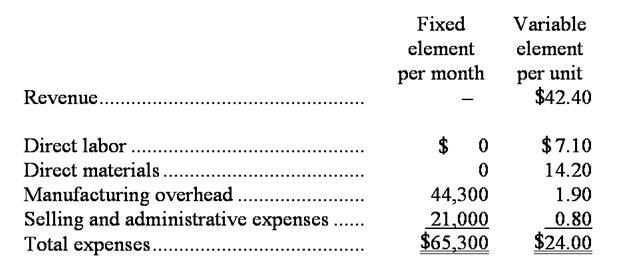

Data used in budgeting:

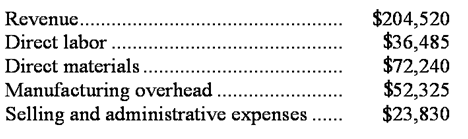

Actual results for August:

-The net operating income in the planning budget for August would be closest to:

Definitions:

Direct Labor Hours

The cumulative hours spent by workers directly engaged in manufacturing products or delivering services.

Activity-Based Cost

A costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption.

Indirect Labor

Labor costs associated with tasks that do not directly contribute to the production of goods or services, such as administrative and maintenance roles.

Activity Pools

Groups of related business activities in activity-based costing, where costs are pooled by common characteristics to allocate them accurately to products or services.

Q22: The activity variance for personnel expenses in

Q28: The budgeted direct labor cost per unit

Q47: What was the West Division's residual income

Q58: Krouse Corporation's manufacturing overhead includes $14.70 per

Q73: Heitkamp Tech is a for-profit vocational school.

Q82: Bahr Corporation has provided the following data

Q140: The simple rate of return would be

Q166: The variable overhead efficiency variance for August

Q176: The selling and administrative expense in the

Q207: The overall revenue and spending variance (i.e.,