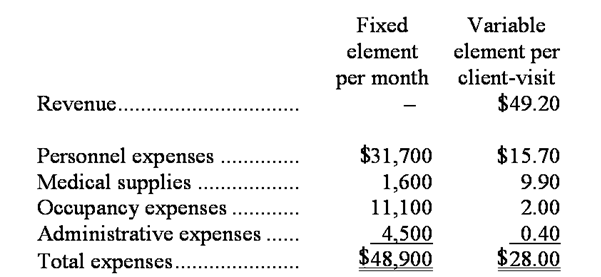

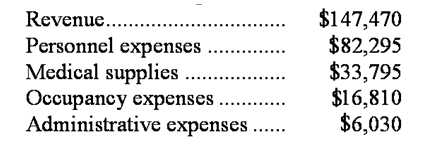

Mock Clinic uses client-visits as its measure of activity. During August, the clinic budgeted for 3,100 client-visits, but its actual level of activity was 3,150 client-visits. The clinic has provided the following data concerning the formulas used in its budgeting and its actual results for August:

Data used in budgeting: Actual results for August:

Actual results for August:

-The net operating income in the planning budget for August would be closest to:

Definitions:

Monetary Unit Assumption

An accounting principle that assumes transactions can be recorded in a stable currency that is the most relevant to the company.

Unit Of Measure

A standard quantity used to express an amount of a physical property, financial item, or activity, facilitating comparisons and calculations.

Economic Entity Assumption

An accounting principle that separates the transactions of a business from those of its owners or other businesses.

Cost Principle

The accounting principle that states goods and services should be recorded at their cost at the time of acquisition.

Q3: The following materials standards have been established

Q29: The Ammon Company uses a standard cost

Q50: Welnor Industrial Gas Corporation supplies acetylene and

Q62: Berol Company plans to sell 200,000 units

Q86: The Fixed component of the predetermined overhead

Q111: The standard cost card for a product

Q140: The spending variance for plane operating costs

Q172: Vera Corporation bases its budgets on the

Q219: The spending variance for materials and supplies

Q282: The spending variance for direct materials in