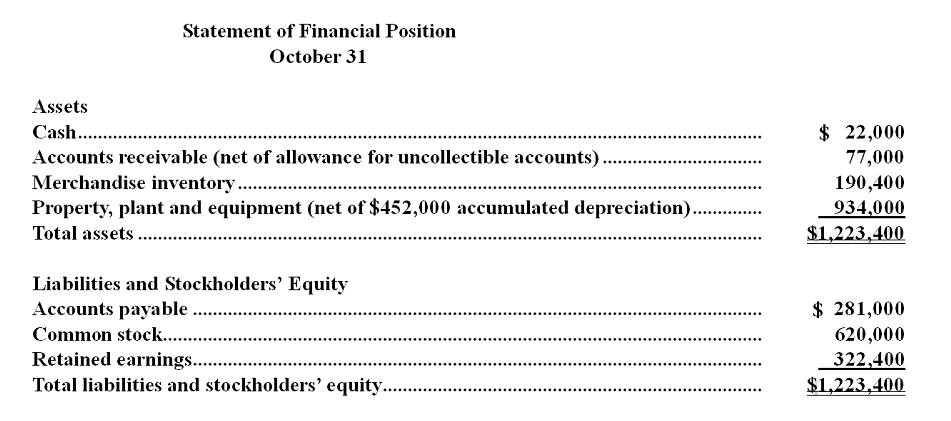

Brarin Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow:

• Sales are budgeted at $340,000 for November, $360,000 for December, and $350,000 for January.

• Collections are expected to be 55% in the month of sale, 44% in the month following the sale, and 1% uncollectible.

• The cost of goods sold is 80% of sales.

• The company would like to maintain ending merchandise inventories equal to 70% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase.

• Other monthly expenses to be paid in cash are $23,100.

• Monthly depreciation is $21,000.

• Ignore taxes.

-Expected cash collections in December are:

Definitions:

Stripped Treasuries

Securities derived from U.S. Treasury bonds by separating the coupons from the principal, allowing them to be sold separately as zero-coupon bonds.

Pure Yield Curve

A theoretical representation of the rates of interest for zero-coupon bonds across different maturities under the assumption of no risk.

Coupon Bond

A type of bond that pays the holder a fixed interest rate (coupon) over its lifetime, and the principal amount is repaid at maturity.

Yield To Maturity

Yield to Maturity (YTM) is the total anticipated return on a bond if the bond is held until it matures, accounting for interest payments and principal repayment.

Q28: The labor rate variance for August is:<br>A)$440

Q45: (Ignore income taxes in this problem.) Whatley

Q51: The manufacturing overhead budget at Latronica Corporation

Q59: The total number of units to be

Q69: Tavorn Corporation applies manufacturing overhead to products

Q79: The materials quantity variance for November is:<br>A)$420

Q94: The direct labor efficiency variance for May

Q120: (Ignore income taxes in this problem.) The

Q123: The materials price variance is:<br>A)$400 U<br>B)$400 F<br>C)$600

Q222: The administrative expenses in the planning budget