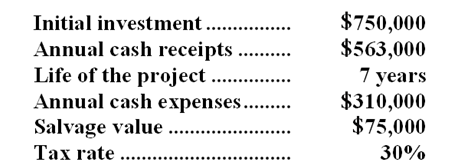

Burry Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 11%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 11%.

-When computing the net present value of the project,what are the annual after-tax cash expenses?

Definitions:

Adoption Credit

A tax credit offered by the IRS to offset some expenses involved in the legal adoption of a child.

Modified AGI

Modified Adjusted Gross Income, an income measure used for tax purposes, adjusting the AGI for specific deductions or exclusions.

Qualified Adoption Expenses

Allowable adoption-related expenses that may be eligible for tax credits, including court costs, attorney fees, and traveling expenses.

Guatemala

A country located in Central America, bordered by Mexico, Belize, Honduras, and El Salvador, known for its rich Mayan heritage and diverse ecosystems.

Q4: The production budget is typically prepared prior

Q25: The company has received a special, one-time-only

Q50: The wages and salaries in the flexible

Q53: The following direct labor standards have been

Q54: Activity-based costing is a costing method that

Q76: Enciso Corporation is preparing its cash budget

Q120: (Ignore income taxes in this problem.) The

Q125: Drewniak Corporation has provided the following data

Q141: (Ignore income taxes in this problem.) A

Q149: The net operating income in the flexible