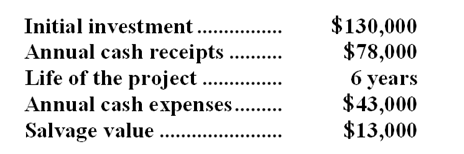

Morgado Inc. has provided the following data to be used in evaluating a proposed investment project:  The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 5 years without any reduction for salvage value. The company uses a discount rate of 19%.

The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 5 years without any reduction for salvage value. The company uses a discount rate of 19%.

-When computing the net present value of the project,what is the after-tax cash flow from the salvage value in the final year?

Definitions:

Annual Dividend

The total amount of dividend payments a company makes to its shareholders over a single fiscal year.

Return

The income generated on an investment over a particular period of time, expressed as a percentage of the investment's initial cost.

Call Option

A financial contract giving the buyer the right, but not the obligation, to purchase a stock, bond, commodity, or other asset at a specified price within a specific time period.

Striking Price

The fixed price at which the holder of an option can buy (in the case of a call) or sell (in the case of a put) the underlying asset.

Q3: If a cost object such as a

Q32: What is the lowest selling price per

Q60: What is the overhead cost assigned to

Q70: What would be the effect on the

Q110: (Ignore income taxes in this problem.) The

Q123: In activity-based costing, there are a number

Q149: Avoidable costs are also called relevant costs.

Q220: The spending variance for occupancy expenses in

Q273: Vieyra Corporation uses customers served as its

Q285: Galligan Corporation bases its budgets on the