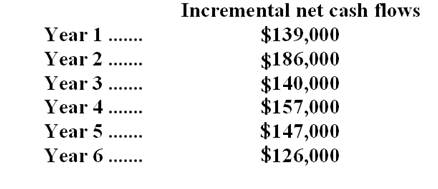

(Ignore income taxes in this problem.) Gull Inc. is considering the acquisition of equipment that costs $480,000 and has a useful life of 6 years with no salvage value. The incremental net cash flows that would be generated by the equipment are:

-If the discount rate is 10%,the net present value of the investment is closest to:

Definitions:

Chemical

A chemical is a substance composed of matter that has a constant composition and characteristic properties.

Multi-Unit Recording Procedures

Techniques used in neuroscience to record the electrical activity from multiple neurons simultaneously, often to study the brain's functional properties.

Motor System

The part of the central and peripheral nervous system that is involved in the movement and coordination of muscles.

Artificial Limb

A prosthetic device designed to replace the function or appearance of a missing arm or leg, enhancing mobility and quality of life for amputees.

Q5: Consider a machine which costs $115,000 now

Q11: (Ignore income taxes in this problem.) Tweedie

Q13: What is the lowest selling price per

Q19: How much of the raw material should

Q27: A manufacturing company that produces a single

Q27: When computing the net present value of

Q31: When computing the net present value of

Q75: Stephen Company produces a single product. Last

Q113: Alongi Corporation uses the following activity rates

Q169: The plane operating costs in the planning