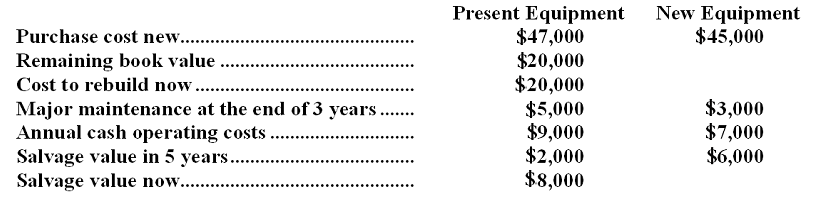

(Ignore income taxes in this problem.) Lichty Car Wash has some equipment that needs to be rebuilt or replaced. The following information has been gathered concerning this decision:  Lichty uses the total-cost approach and a discount rate of 10% in making capital budgeting decisions. Regardless of which option is chosen, rebuild or replace, at the end of five years Mr. Lichty plans to close the car wash and retire.

Lichty uses the total-cost approach and a discount rate of 10% in making capital budgeting decisions. Regardless of which option is chosen, rebuild or replace, at the end of five years Mr. Lichty plans to close the car wash and retire.

-If the new equipment is purchased,the present value of the annual cash operating costs associated with this alternative is:

Definitions:

Offer Price

The price at which someone is willing to sell a security, asset, or commodity; also known as the ask price.

Price-Earnings Ratio

A financial metric used to evaluate a company's share price relative to its per-share earnings, indicating how much investors are willing to pay per dollar of earnings.

Fixed Assets

Long-term tangible assets held for business use and not expected to be converted to cash in the current or upcoming fiscal year.

Net Present Value

Net Present Value (NPV) represents the disparity between cash inflows' present value and cash outflows' present value throughout a specified timeframe.

Q6: If a cost object such as a

Q9: When computing the net present value of

Q31: What is the overhead cost assigned to

Q50: The wages and salaries in the flexible

Q56: The management of Heider Corporation is considering

Q84: The spending variance for expendables in June

Q96: The personnel expenses in the planning budget

Q174: Clayton Company produces a single product. Last

Q180: The total contribution margin for the month

Q260: The activity variance for administrative expenses in