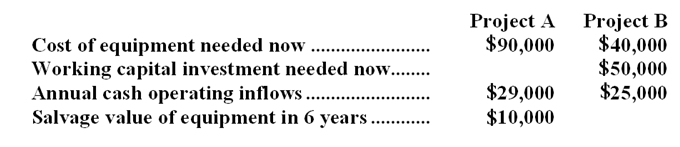

(Ignore income taxes in this problem.) Rushforth Manufacturing has $90,000 to invest in either Project A or Project B. The following data are available on these projects:  Both projects will have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Rushforth's required rate of return is 14%.

Both projects will have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Rushforth's required rate of return is 14%.

-The net present value of Project B is:

Definitions:

Flexor Pollicis Brevis

A muscle in the hand that flexes the thumb, contributing to the thumb's gripping function.

Hypothenar

The fleshy mass at the base of the little finger, composed of muscles used in controlling the movement of the pinky.

Palmar Interosseous

Muscles located on the palm of the hand, responsible for the movement and positioning of the fingers.

Extensor Muscle

A muscle whose contraction causes an extension of a limb or part of the body.

Q10: (Ignore income taxes in this problem.) Virani

Q10: The Carlquist Company makes and sells a

Q39: The net operating income in the flexible

Q46: Spendlove Corporation has provided the following data

Q74: Costs associated with two alternatives, code-named Q

Q81: If management decides to buy part R20

Q97: What is the overhead cost assigned to

Q112: The activity rate for the Processing activity

Q126: The activity variance for direct labor in

Q127: A general rule in relevant cost analysis