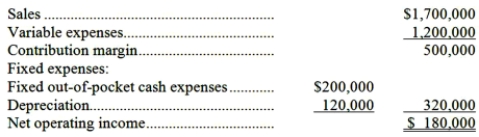

(Ignore income taxes in this problem.) Tranter, Inc., is considering a project that would have a ten-year life and would require a $1,200,000 investment in equipment. At the end of ten years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows:  All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 12%.

All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 12%.

Required:

a. Compute the project's net present value.

b. Compute the project's internal rate of return to the nearest whole percent.

c. Compute the project's payback period.

d. Compute the project's simple rate of return.

Definitions:

Facial Expressions

Movements of the facial muscles that convey an individual's emotions, intentions, or social signals.

Deceiving Expressions

Facial expressions that are intentionally misleading, often used to disguise true emotions or intentions.

Fearful Expressions

Facial expressions that convey fear, often characterized by widened eyes, raised eyebrows, and a tensed mouth, serving as non-verbal communication of emotion.

Angry Expressions

Are facial and body signals that convey feelings of anger, which can be a response to perceived threats or injustices and serve communicative and adaptive functions in social interactions.

Q33: Variable manufacturing overhead costs are treated as

Q61: Which of the following statements is not

Q88: A proposal has been made that will

Q91: What is the net advantage or disadvantage

Q113: Power Systems Inc. manufactures jet engines for

Q115: If new equipment is replacing old equipment,

Q132: Sroufe Clinic bases its budgets on the

Q136: An activity-based costing system should include all

Q239: The revenue variance for April would be

Q261: The activity variance for net operating income