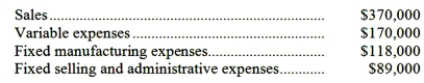

The management of Rodarmel Corporation is considering dropping product G91Q. Data from the company's accounting system appear below:  All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $57,000 of the fixed manufacturing expenses and $40,000 of the fixed selling and administrative expenses are avoidable if product G91Q is discontinued.

All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $57,000 of the fixed manufacturing expenses and $40,000 of the fixed selling and administrative expenses are avoidable if product G91Q is discontinued.

Required:

a. What is the net operating income earned by product G91Q according to the company's accounting system? Show your work!

b. What would be the effect on the company's overall net operating income of dropping product G91Q? Should the product be dropped? Show your work!

Definitions:

Q8: If a cost object such as a

Q18: If Dunford has a limit of 20,000

Q20: (Ignore income taxes in this problem.) The

Q21: If the company bases its predetermined overhead

Q49: The predetermined overhead rate is closest to:<br>A)$42.30<br>B)$41.82<br>C)$42.12<br>D)$42.00

Q54: The total number of units produced in

Q66: Future costs that do not differ among

Q101: If the total budgeted selling and administrative

Q118: Which of the intermediate products should be

Q280: Pinion Memorial Diner is a charity supported