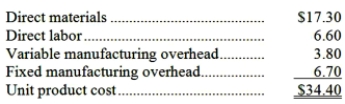

Holtrop Corporation has received a request for a special order of 9,000 units of product Z74 for $46.50 each. The normal selling price of this product is $51.60 each, but the units would need to be modified slightly for the customer. The normal unit product cost of product Z74 is computed as follows:  Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product Z74 that would increase the variable costs by $6.20 per unit and that would require a one-time investment of $46,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product Z74 that would increase the variable costs by $6.20 per unit and that would require a one-time investment of $46,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.

Required:

Determine the effect on the company's total net operating income of accepting the special order. Show your work!

Definitions:

Preferred Stock

A class of ownership in a corporation that has a higher claim on assets and earnings than common stock, often with fixed dividends.

Common Stock

A type of equity security that represents ownership in a corporation, with rights to vote on corporate matters and receive dividends.

Consolidated Income Statement

A financial statement that summarizes the revenue, expenses, and profits of a parent company and its subsidiaries.

Bonds Payable

A long-term debt instrument issued by a company or government agency, promising to pay its holder a specified sum of money at a future date plus periodic interest payments.

Q2: (Ignore income taxes in this problem.) Stutz

Q7: Kelsh Company uses a predetermined overhead rate

Q16: (Ignore income taxes in this problem.) The

Q55: (Ignore income taxes in this problem.) An

Q57: Data concerning three of the activity cost

Q74: Araiza Inc. uses a job-order costing system

Q77: Fixed costs that are traceable to a

Q91: What is the overhead cost assigned to

Q93: Even departmental overhead rates will not correctly

Q96: A properly constructed segmented income statement in