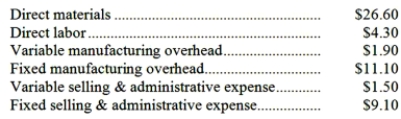

Jumonville Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 70,000 units per month is as follows:  The normal selling price of the product is $56.70 per unit.

The normal selling price of the product is $56.70 per unit.

An order has been received from an overseas customer for 2,000 units to be delivered this month at a special discounted price. This order would have no effect on the company's normal sales and would not change the total amount of the company's fixed costs. The variable selling and administrative expense would be $0.70 less per unit on this order than on normal sales.

Direct labor is a variable cost in this company.

Required:

a. Suppose there is ample idle capacity to produce the units required by the overseas customer and the special discounted price on the special order is $51.20 per unit. By how much would this special order increase (decrease) the company's net operating income for the month?

b. Suppose the company is already operating at capacity when the special order is received from the overseas customer. What would be the opportunity cost of each unit delivered to the overseas customer?

c. Suppose there is not enough idle capacity to produce all of the units for the overseas customer and accepting the special order would require cutting back on production of 700 units for regular customers. What would be the minimum acceptable price per unit for the special order?

Definitions:

Market Demand Curve

A graph that shows the relationship between the price of a good and the quantity of that good all consumers are willing to purchase at each price level.

Consumption

The act of using goods and services for personal needs or wants.

Demand Curve

A graphical representation showing the relationship between the price of a good and the amount of it that consumers are willing to purchase at various prices.

Quantity Demanded

The total amount of a good or service consumers are willing and able to purchase at a given price in a specified period.

Q20: The net present value of the project

Q22: The payback period for the investment is

Q28: A customer has asked Twiner Corporation to

Q64: What is the maximum amount the company

Q68: The net income for December would be:<br>A)$66,400<br>B)$43,900<br>C)$47,400<br>D)$61,500

Q72: If the discount rate is 11%, the

Q73: Freeman Company uses a predetermined overhead rate

Q95: (Ignore income taxes in this problem.) Limon

Q124: The contribution margin for Product R was:<br>A)$48,750<br>B)$63,500<br>C)$51,000<br>D)$48,000

Q143: At what selling price per unit should