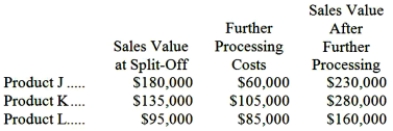

Harris Corp. manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $200,000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point.

Each product may be sold at the split-off point or processed further. The additional processing costs and sales value after further processing for each product (on an annual basis) are:  The "Further Processing Costs" consist of variable and avoidable fixed costs.

The "Further Processing Costs" consist of variable and avoidable fixed costs.

Required:

Which product or products should be sold at the split-off point, and which product or products should be processed further? Show computations.

Definitions:

Copy

Copy is the operation of duplicating information or data from a source to a destination while leaving the source unchanged.

Paste

The action of inserting data or content that has been copied or cut from one location to another.

Themes Gallery

A collection or library of pre-designed themes in software applications that provide consistent visual styles and formatting options across documents.

Thumbnail

A small image or preview that represents a larger image or file, often used to make browsing or searching for content easier.

Q15: What is the total period cost for

Q21: Shuck Inc. bases its manufacturing overhead budget

Q25: What is Leija's cost of goods manufactured

Q26: If the company bases its predetermined overhead

Q46: Spendlove Corporation has provided the following data

Q81: How much overhead cost is allocated to

Q131: The simple rate of return, to the

Q151: A manufacturing company that produces a single

Q173: The net operating income for the company

Q238: Glassey Clinic uses patient-visits as its measure