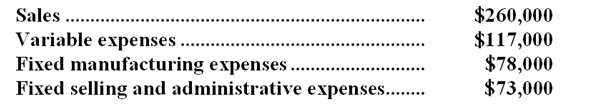

The management of Fries Corporation has been concerned for some time with the financial performance of its product R89H and has considered discontinuing it on several occasions. Data from the company's accounting system appear below:  In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $31,000 of the fixed manufacturing expenses and $46,000 of the fixed selling and administrative expenses are avoidable if product R89H is discontinued.

In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $31,000 of the fixed manufacturing expenses and $46,000 of the fixed selling and administrative expenses are avoidable if product R89H is discontinued.

-According to the company's accounting system,what is the net operating income earned by product R89H?

Definitions:

Net Pay

The amount of money an employee takes home after deductions such as taxes and retirement contributions have been subtracted from their gross salary.

Voluntary Deductions

These are payroll deductions that an employee chooses to have withheld from their paycheck, such as for retirement plans, health insurance, or union dues.

Health Insurance

Health insurance is a form of insurance coverage that typically pays for medical, surgical, prescription drug, and sometimes dental expenses incurred by the insured.

Retirement Plan

A financial arrangement designed to replace employment income upon retirement, often including contributions from both the employer and employee.

Q30: The entire difference between the actual manufacturing

Q35: A company anticipates a taxable cash receipt

Q37: One benefit of budgeting is that it

Q43: Kindschuh Corporation is working on its direct

Q46: (Ignore income taxes in this problem.) Buy-Rite

Q46: The marketing department believes that a promotional

Q121: The contribution margin is viewed as a

Q163: The net operating income for the year

Q175: Sproles Inc. manufactures a variety of products.

Q221: The total fixed cost at the activity