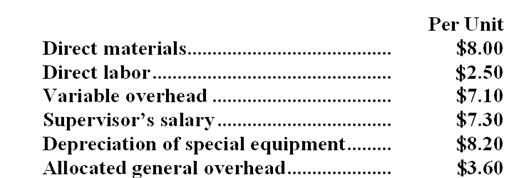

Knaack Corporation is presently making part R20 that is used in one of its products. A total of 18,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $27.70 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

An outside supplier has offered to produce and sell the part to the company for $27.70 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

-In addition to the facts given above,assume that the space used to produce part R20 could be used to make more of one of the company's other products,generating an additional segment margin of $27,000 per year for that product.What would be the impact on the company's overall net operating income of buying part R20 from the outside supplier and using the freed space to make more of the other product?

Definitions:

Instinctual

Relating to or based on instinct, innate patterns of behavior that are not learned.

Gender Role

A set of expectations that prescribes how females or males should think, act, and feel.

Nurturing

Providing care, support, and encouragement, fostering growth and development.

Androgens

A group of hormones that play a role in male traits and reproductive activity; present in both males and females.

Q4: The net present value of the project

Q9: The present value of a given amount

Q12: Ethridge Corporation is presently making part H25

Q16: The selling and administrative expense budget of

Q29: If the sales in Division L increase

Q59: (Ignore income taxes in this problem.) An

Q69: A common cost that should not be

Q87: If Immanuel accepts this special order, the

Q88: The activity rate for the Supervising activity

Q126: Assume straight-line depreciation and no salvage value.