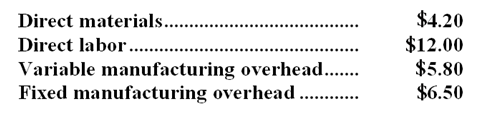

The Rodgers Company makes 27,000 units of a certain component each year for use in one of its products. The cost per unit for the component at this level of activity is as follows:  Rodgers has received an offer from an outside supplier who is willing to provide 27,000 units of this component each year at a price of $25 per component. Assume that direct labor is a variable cost. None of the fixed manufacturing overhead would be avoidable if this component were purchased from the outside supplier.

Rodgers has received an offer from an outside supplier who is willing to provide 27,000 units of this component each year at a price of $25 per component. Assume that direct labor is a variable cost. None of the fixed manufacturing overhead would be avoidable if this component were purchased from the outside supplier.

-Assume that if the component is purchased from the outside supplier,$35,100 of annual fixed manufacturing overhead would be avoided and the facilities now being used to make the component would be rented to another company for $64,800 per year.If Rodgers chooses to buy the component from the outside supplier under these circumstances,then the impact on annual net operating income due to accepting the offer would be:

Definitions:

Attitudes toward death

The beliefs, feelings, and reactions individuals have about death and dying, which can vary greatly across different cultures and individuals.

Elderly people

A demographic group typically categorized as 65 years or older, recognized for experiencing various social, health, and economic challenges unique to their age group.

Anxiety

A feeling of worry, nervousness, or unease about something with an uncertain outcome, often accompanied by physical symptoms.

Self-determination theory

A psychological theory of motivation that emphasizes the importance of autonomy, competence, and relatedness in fostering well-being.

Q4: If the company bases its predetermined overhead

Q5: An action analysis report provides more detail

Q19: The management of Griswell Corporation would like

Q34: Hagos Corporation is working on its direct

Q61: The present value of the annual cost

Q81: How much overhead cost is allocated to

Q89: The total cost of Jurislon to be

Q93: The carrying value on the balance sheet

Q111: (Ignore income taxes in this problem.) Juliar

Q250: The direct materials in the flexible budget