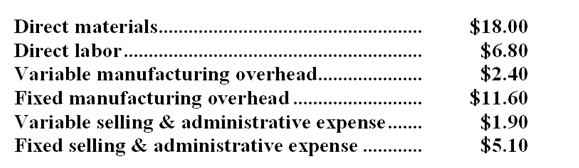

Elhard Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 40,000 units per month is as follows: The normal selling price of the product is $51.10 per unit.

The normal selling price of the product is $51.10 per unit.

An order has been received from an overseas customer for 2,000 units to be delivered this month at a special discounted price. This order would have no effect on the company's normal sales and would not change the total amount of the company's fixed costs. The variable selling and administrative expense would be $0.10 less per unit on this order than on normal sales.

Direct labor is a variable cost in this company.

-Suppose there is not enough idle capacity to produce all of the units for the overseas customer and accepting the special order would require cutting back on production of 200 units for regular customers.The minimum acceptable price per unit for the special order is closest to:

Definitions:

Incidental Costs

Incidental costs refer to minor or secondary expenses that are not planned for but occur in the course of conducting business.

LIFO

Last In, First Out, an inventory valuation method where the most recently produced items are recorded as sold first.

Current Costs

The cost associated with purchasing goods or services in the present time, often used in accounting to refer to the cost of inventory or services consumed.

Weighted Average Method

An inventory costing method that assigns a cost to inventory items based on the weighted average cost of all similar items purchased or produced during a period.

Q9: Hansen Company produces a single product. During

Q13: The May cash disbursements for manufacturing overhead

Q28: The budgeted direct labor cost per unit

Q41: The selling and administrative expenses in the

Q66: The project profitability index is used to

Q71: Assuming that the company charges $613.98 for

Q119: UHF Antennas, Inc., produces and sells a

Q134: The Kelsh Company has two divisions--North and

Q174: Clayton Company produces a single product. Last

Q191: Selling and administrative expenses are considered to