Harris Corp. manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $200,000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point.

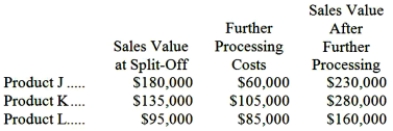

Each product may be sold at the split-off point or processed further. The additional processing costs and sales value after further processing for each product (on an annual basis) are:  The "Further Processing Costs" consist of variable and avoidable fixed costs.

The "Further Processing Costs" consist of variable and avoidable fixed costs.

Required:

Which product or products should be sold at the split-off point, and which product or products should be processed further? Show computations.

Definitions:

Practices

Repeated or habitual actions, methods, or operations in a particular field or discipline.

Direct Statements

Clear and straightforward expressions that communicate an idea assertively and without ambiguity.

Motivational Factor

An element or circumstance that stimulates an individual’s enthusiasm, energy, or desire to undertake specific actions or persevere in a task.

Praises

Expressions of approval, commendation, or admiration directed towards a person, group, or entity.

Q15: Currey Inc., which uses job-order costing,

Q29: If the sales in Division L increase

Q35: Bertone Inc., which produces a single product,

Q46: Sandler Corporation bases its predetermined overhead rate

Q52: Pitkin Company produces a part used in

Q57: Data concerning three of the activity cost

Q68: What is the net operating income for

Q98: Freestone Company is considering renting Machine Y

Q236: Cecere Tech is a for-profit vocational school.

Q273: Vieyra Corporation uses customers served as its