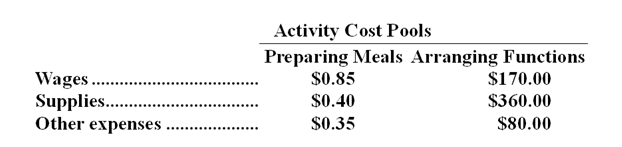

Groenen Catering uses activity-based costing for its overhead costs. The company has provided the following data concerning the activity rates in its activity-based costing system:  The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

Management would like to know whether the company made any money on a recent function at which 120 meals were served. The company catered the function for a fixed price of $20.00 per meal. The cost of the raw ingredients for the meals was $13.05 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above.

For the purposes of preparing action analyses, management has assigned ease of adjustment codes to the costs as follows: wages are classified as a Yellow cost; supplies and raw ingredients as a Green cost; and other expenses as a Red cost.

-According to the activity-based costing system,what was the total cost (including the costs of raw ingredients) of the function mentioned above? (Round to the nearest whole dollar. )

Definitions:

Non-Taxable Events

Financial transactions that do not affect an individual's or corporation's tax liability.

Complementary Resources

Assets or resources that when combined with another firm’s assets or resources enhance the overall value or performance.

Ski Resort

A specialized tourist facility that offers skiing and snowboarding activities along with amenities like lodging, food services, and equipment rental.

Golf Resort

A specialized leisure facility often combining a hotel and golf courses along with other amenities such as spa services, restaurants, and event spaces.

Q37: When reconciling variable costing and absorption costing

Q65: (Ignore income taxes in this problem) The

Q66: The overhead for the year was:<br>A)$1,520 underapplied<br>B)$2,520

Q98: Freestone Company is considering renting Machine Y

Q114: Janus Corporation has in stock 43,700 kilograms

Q120: How much supervisory wages and factory supplies

Q129: More Company has two divisions, L and

Q136: Cuffee Inc., which produces a single product,

Q254: Carnes Tech is a for-profit vocational school.

Q269: Moss Clinic bases its budgets on the