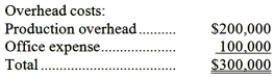

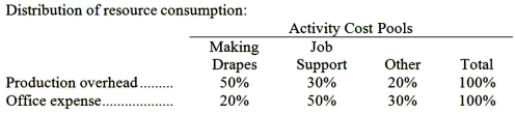

Inskeep Draperies makes custom draperies for homes and businesses. The company uses an activity-based costing system for its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity cost pools.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

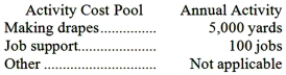

The amount of activity for the year is as follows:  Required:

Required:

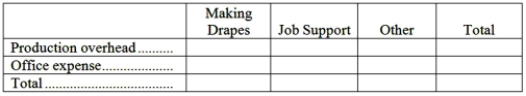

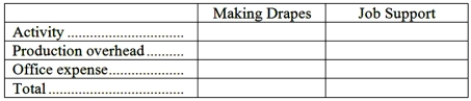

a. Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:  b. Compute the activity rates (i.e., cost per unit of activity) for the Making Drapes and Job Support activity cost pools by filling in the table below:

b. Compute the activity rates (i.e., cost per unit of activity) for the Making Drapes and Job Support activity cost pools by filling in the table below:  c. Prepare an action analysis report in good form of a job that involves making 70 yards of drapes and has direct materials and direct labor cost of $1,870. The sales revenue from this job is $3,700.

c. Prepare an action analysis report in good form of a job that involves making 70 yards of drapes and has direct materials and direct labor cost of $1,870. The sales revenue from this job is $3,700.

For purposes of this action analysis report, direct materials and direct labor should be classified as a Green cost; production overhead as a Red cost; and office expense as a Yellow cost.

Definitions:

Intramuscular Dose

A method of administering medication directly into a muscle, allowing for quick absorption into the bloodstream.

Increasingly More Aggressive

Becoming progressively more forceful, hostile, or assertive in behavior or attitudes.

Startle Reactions

The automatic, rapid response of the body to a sudden, unexpected stimulus, usually perceived as potentially threatening.

Difficulty Sleeping

Challenges or disturbances in falling asleep or staying asleep through the night, which may result in insufficient sleep.

Q1: Which of the following is not a

Q9: The impact on net operating income of

Q43: Kindschuh Corporation is working on its direct

Q52: Zee Corporation has provided the following data

Q56: Segmented statements for internal use should be

Q60: The manufacturing overhead budget at Cutchin Corporation

Q68: A job cost sheet is used to

Q113: Alongi Corporation uses the following activity rates

Q157: The total volume in sales dollars that

Q194: Under variable costing, fixed manufacturing overhead cost