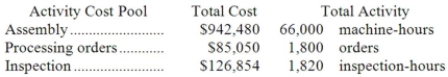

Drewniak Corporation has provided the following data from its activity-based costing system:  The company makes 430 units of product O37W a year, requiring a total of 690 machine-hours, 40 orders, and 10 inspection-hours per year. The product's direct materials cost is $35.72 per unit and its direct labor cost is $29.46 per unit. According to the activity-based costing system, the average cost of product O37W is closest to:

The company makes 430 units of product O37W a year, requiring a total of 690 machine-hours, 40 orders, and 10 inspection-hours per year. The product's direct materials cost is $35.72 per unit and its direct labor cost is $29.46 per unit. According to the activity-based costing system, the average cost of product O37W is closest to:

Definitions:

Corporate Tax Rate

The percentage of a corporation's income that is paid to the government as tax.

CCA Class

In the context of Canadian taxation, a method to categorize depreciable property according to its class for the purpose of determining capital cost allowance rates.

Incremental Cash Flow

The additional cash flow a company receives from taking on a new project, considering both the inflows and outflows caused by the project.

Tax Rate

The percentage at which an individual or corporation is taxed; can refer to the nominal rate (before any deductions) or effective rate (after deductions).

Q1: Designing a new product is an example

Q12: Hasher Hardwood Floors installs oak and other

Q15: What is the total period cost for

Q49: The activity rate for the batch setup

Q56: Segmented statements for internal use should be

Q95: Capati Corporation is working on its direct

Q105: What was the absorption costing net operating

Q174: Clayton Company produces a single product. Last

Q181: The total gross margin for the month

Q223: Break-even analysis assumes that:<br>A)total costs are constant.<br>B)the