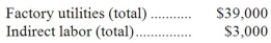

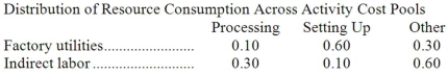

Day Corporation has an activity-based costing system with three activity cost pools-Processing, Setting Up, and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Data concerning the company's costs and activity-based costing system appear below:

Required:

Required:

Assign overhead costs to activity cost pools using activity-based costing.

Definitions:

Fair Value

An estimate of the price at which an asset or liability would be traded in a fair transaction between willing and knowledgeable participants.

Q28: Claycamp Inc. uses a job-order costing in

Q33: Variable manufacturing overhead costs are treated as

Q43: Lampshire Inc. is considering using stocks of

Q43: Kindschuh Corporation is working on its direct

Q61: The present value of the annual cost

Q76: Under absorption costing, the cost of goods

Q79: Underapplied or overapplied overhead represents the difference

Q95: Cosmo is considering a promotional campaign at

Q133: Joint costs are not relevant to the

Q180: The total contribution margin for the month