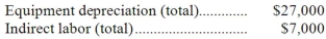

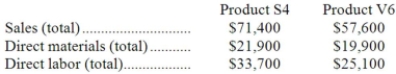

Pressler Corporation's activity-based costing system has three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.

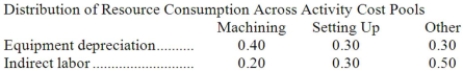

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.  Additional data concerning the company's products appears below:

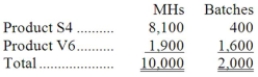

Additional data concerning the company's products appears below:  Required:

Required:

a. Assign overhead costs to activity cost pools using activity-based costing.

b. Calculate activity rates for each activity cost pool using activity-based costing.

c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

d. Determine the product margins for each product using activity-based costing.

Definitions:

Authorized

The formal approval or sanction for an action or the maximum amount of capital stock that a company can issue as authorized by its corporate charter.

Treasury

A department of government or a corporate department responsible for managing all financial operations, including issuing money, managing government or corporate debt, and executing monetary policy.

Shares

Units of ownership interest in a corporation or financial asset, representing a portion of the company.

Consideration Received

The value obtained in exchange for goods or services offered, often represented in monetary terms but can include other forms of value.

Q1: If two projects require the same amount

Q11: Organization-sustaining activities are activities of the general

Q16: (Ignore income taxes in this problem.) The

Q24: Costs which are always relevant in decision

Q35: (Ignore income taxes in this problem.) Gocke

Q60: If two companies have the same total

Q76: Kach Corporation uses an activity-based costing system

Q98: There are two acceptable methods for closing

Q119: UHF Antennas, Inc., produces and sells a

Q123: Ignoring the cash inflows, to the nearest