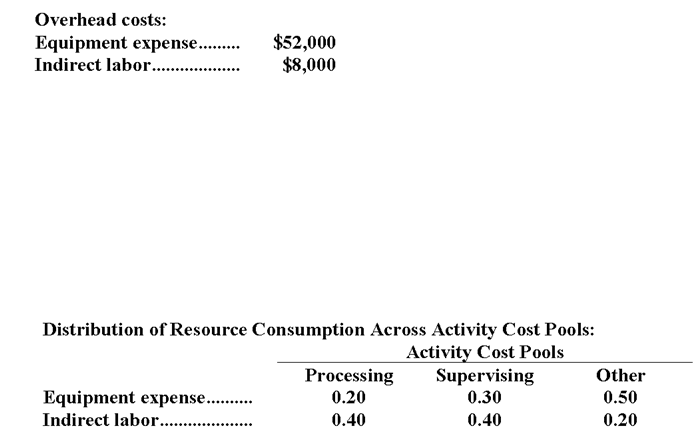

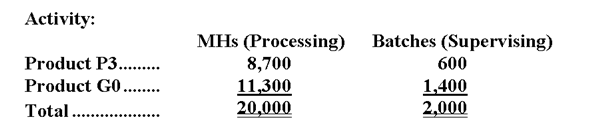

Roshannon Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts-equipment expense and indirect labor-to three activity cost pools-Processing, Supervising, and Other-based on resource consumption. Data to perform these allocations appear below:  In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

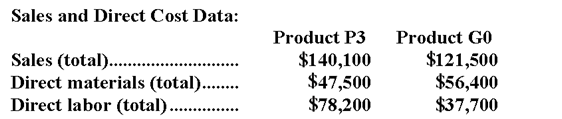

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

-How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Hostile Indians

A term historically used to describe Native American groups that resisted European and American expansion and policies, now considered outdated and offensive.

Southeastern Europe

A geographic region in Europe, including countries such as Greece, Bulgaria, and Romania.

Southeast Asia

A geographic region in Asia that includes countries such as Thailand, Vietnam, Singapore, Indonesia, and the Philippines, characterized by diverse cultures and languages.

Northwestern Europe

A geographical region in Europe that includes countries like the United Kingdom, Ireland, the Netherlands, Germany, and the Nordic countries, known for its distinct climate, economic development, and culture.

Q23: Management is considering purchasing an asset for

Q26: Findt & Thompson PLC, a consulting firm,

Q47: The unadjusted cost of goods sold (in

Q48: What is the product margin for Product

Q66: Future costs that do not differ among

Q101: If the number of units produced exceeds

Q105: Consider the following production and cost data

Q116: The Cost of Goods Manufactured represents:<br>A)the amount

Q131: The simple rate of return, to the

Q196: Street Company's fixed expenses total $150,000, its