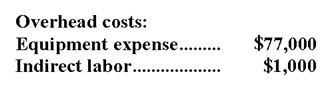

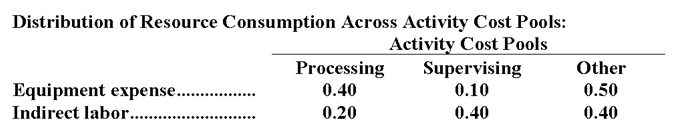

Traughber Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs-equipment expense and indirect labor-are allocated to the three activity cost pools-Processing, Supervising, and Other-based on resource consumption. Data to perform these allocations appear below:

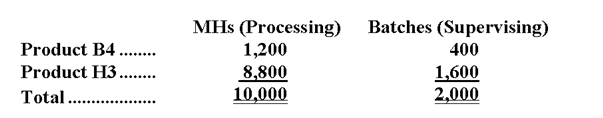

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

-What is the overhead cost assigned to Product B4 under activity-based costing?

Definitions:

Anonymity

Occurs when the researcher cannot make a connection between respondents and evidence.

Operationalization

Operationalization is the process of defining and measuring variables, concepts, or phenomena in order to make them quantifiable and testable within research studies.

Social Class Position

Social class position refers to an individual's or group's place within a hierarchical social structure, often determined by factors such as wealth, occupation, education, and power.

Income

The financial gain received by an individual or household, often derived from work, investments, or other sources, and used for consumption and savings.

Q7: Kelsh Company uses a predetermined overhead rate

Q10: Not all cash inflows are taxable.

Q19: Which of the intermediate products should be

Q24: The profitability index of investment project N

Q53: Tsuchiya Corporation manufactures a variety of products.

Q78: The activity rate for the Machining activity

Q124: Are the materials costs and processing costs

Q155: Under absorption costing, the unit product cost

Q165: Net operating income for the company was:<br>A)$166,000<br>B)$256,000<br>C)$334,000<br>D)$46,000

Q236: The amount by which a company's sales