Dykema Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools-Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

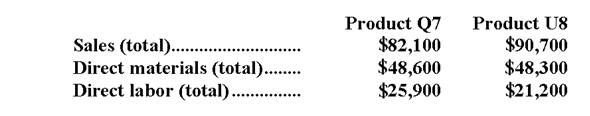

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

-What is the product margin for Product Q7 under activity-based costing?

Definitions:

Sabbatical

A period of paid or unpaid leave granted to an employee, typically for research or study, allowing personal growth and development beyond traditional vacation time.

New Skills

Abilities or expertise that individuals acquire through learning or training to perform new or improved tasks.

Stresses

Physical or psychological strains and pressures that can result from various challenges or demands.

Goal Setting

The process of identifying specific, measurable, achievable, relevant, and time-bound objectives to focus efforts towards achieving them.

Q7: The net present value of the proposed

Q29: Last year the sales at Jersey Company

Q35: Simoneaux Corporation bases its predetermined overhead rate

Q64: Activity rates from Quattrone Corporation's activity-based costing

Q70: Which of the following formulas is used

Q79: Underapplied or overapplied overhead represents the difference

Q96: The amount of direct materials cost in

Q98: If a company has computed the project

Q99: If Store Q sales increase by $30,000

Q184: The unit product cost under variable costing