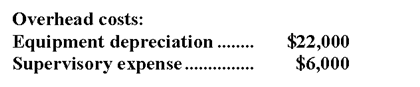

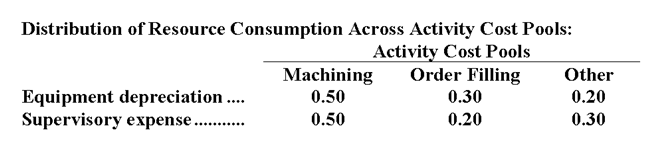

Brisky Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts-equipment depreciation and supervisory expense-to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption. Data to perform these allocations appear below:

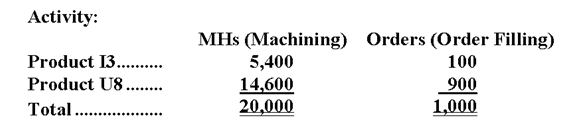

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.

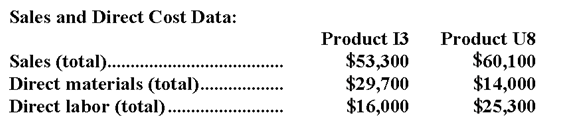

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.  Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

-How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Owner

The person or entity that has legal title, possession, or control over property, assets, or goods, and has the right to use, manage, and dispose of them.

Concurrent Property Ownership

Refers to a situation where two or more parties hold ownership rights in a single piece of property simultaneously.

Cooperative

An organization owned and operated by a group of individuals for their mutual benefit.

Fee Simple Absolute

The most complete form of property ownership, giving the owner total control and rights to the property.

Q5: Which of the following documents is used

Q20: Malcolm Company uses a predetermined overhead rate

Q30: Preference decisions attempt to determine which of

Q53: Paskey Inc. uses a job-order costing system

Q70: The company recomputes its predetermined overhead rate

Q86: Under absorption costing, the ending inventory for

Q99: A very useful guide for making investment

Q111: Rothery Co. manufactures and sells medals for

Q149: The following information pertains to Clove Co.:

Q219: A company has provided the following data: