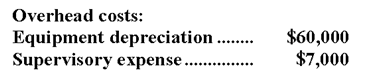

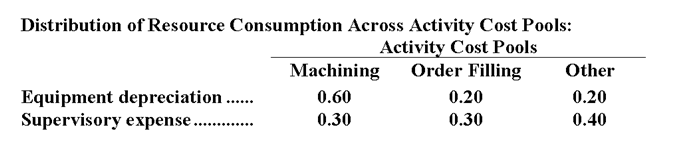

Laningham Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs-equipment depreciation and supervisory expense-are allocated to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption. Data to perform these allocations appear below:

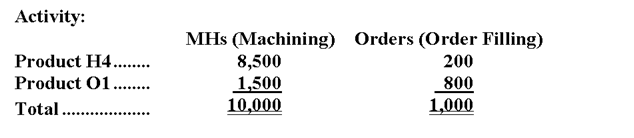

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

-The activity rate for the Machining activity cost pool under activity-based costing is closest to:

Definitions:

Sales Increase

A situation where the number or volume of products or services sold by a company rises during a specific period, indicating growth or demand.

Accounts Receivable

Funds that customers owe to a business for goods or services already provided but not yet compensated for.

Sales Projection

An estimate of the future sales revenue of a company, often based on historical sales data and market analysis.

Net Income

The amount of money a company retains as profit after removing expenses and taxes from its revenue.

Q8: (Ignore income taxes in this problem.) Girman

Q13: Costs classified as batch-level costs should depend

Q44: For the month referred to above, net

Q45: If Austin chooses to produce 4,000 afghans

Q51: What is the net monetary advantage (disadvantage)

Q73: The salary paid to a store manager

Q93: Schuppert Inc. uses a job-order costing system

Q103: The activity rate for Machining under activity-based

Q109: With regard to the CVP graph, which

Q126: What is the net operating income for