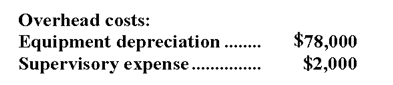

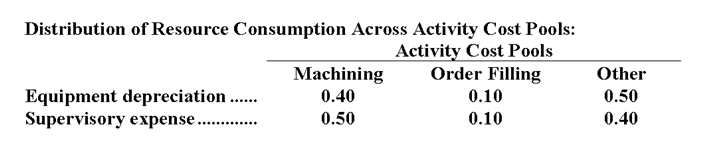

Capizzi Corporation has an activity-based costing system with three activity cost pools-Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow:

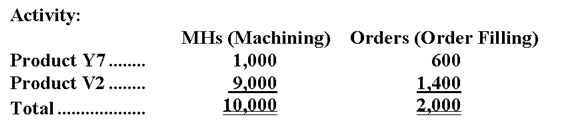

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

-How much overhead cost is allocated to the Order Filling activity cost pool under activity-based costing?

Definitions:

Marginal Cost Curve

A graphical representation showing how the cost of producing one more unit of a good varies with the level of output.

Average Revenue

Total revenue from the sale of a product divided by the quantity of the product sold (demanded); equal to the price at which the product is sold when all units of the product are sold at the same price.

Average Cost

is the cost per unit of output, calculated by dividing total costs by the total quantity of output produced.

Patent

A legal document granted by the government, giving an inventor exclusive rights to use, make, and sell an invention for a certain period of time.

Q7: Assume that there is no other use

Q30: Stephen Company has the following data for

Q31: If the company has budgeted to sell

Q33: Coakley Beet Processors, Inc., processes sugar beets

Q60: The total contribution margin for the month

Q92: What is the differential cost of Alternative

Q94: What is the overhead cost assigned to

Q118: (Ignore income taxes in this problem.) A

Q125: Tanigawa Inc. has an operating leverage of

Q144: If Eagle had sold only 9,000 tables