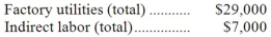

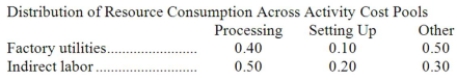

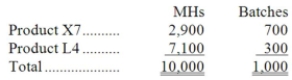

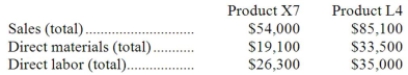

Murri Corporation has an activity-based costing system with three activity cost pools-Processing, Setting Up, and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Costs in the Processing cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear below:

Required:

Required:

a. Assign overhead costs to activity cost pools using activity-based costing.

b. Calculate activity rates for each activity cost pool using activity-based costing.

c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

d. Determine the product margins for each product using activity-based costing.

Definitions:

Personality Psychology

Personality psychology is the study of individual differences in characteristic patterns of thinking, feeling, and behaving.

Organizational

Organizational pertains to the structure and coordination of the activities of a group or entity towards achieving its goals.

Basic Approach

A fundamental strategy or methodology used in a particular field of study or profession, focusing on core principles and techniques.

Personality

A set of emotional, cognitive, and behavioral patterns that are stable over time and across situations, distinguishing one person from another.

Q1: Designing a new product is an example

Q5: Consider a machine which costs $115,000 now

Q12: Hasher Hardwood Floors installs oak and other

Q21: Period costs are expensed as incurred, rather

Q23: Mccoo Inc. bases its manufacturing overhead budget

Q69: A common cost that should not be

Q100: (Ignore income taxes in this problem.) Rosenholm

Q108: Last year, Farrer Corporation had sales of

Q137: Mr. Earl Pearl, accountant for Margie Knall

Q169: Moore Company produces a single product. During