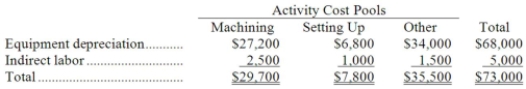

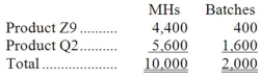

Narayan Corporation has an activity-based costing system with three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, have been allocated to the cost pools already and are provided in the table below.  Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

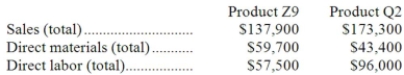

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

Definitions:

Vietnam Conflict

A prolonged war (1955-1975) between North Vietnam, supported by its communist allies, and South Vietnam, supported by the United States.

Federal Government

The Federal Government is the national government of a federal country, which has specific powers delegated to it by a constitution, distinguishing it from the governmental entities of individual states or provinces.

Crime Control

Measures and policies implemented to prevent, reduce, and manage crime in society.

Me Decade

A term used to describe the 1970s in the United States, characterized by a cultural shift towards personal self-realization and individualism.

Q10: Eggins Inc. uses a job-order costing system

Q13: If the company bases its predetermined overhead

Q14: The reduction in taxes made possible by

Q25: What would the annual net cash inflows

Q30: The entire difference between the actual manufacturing

Q52: Pitkin Company produces a part used in

Q55: Evans Company produces a single product. During

Q56: Segmented statements for internal use should be

Q62: What was the absorption costing net operating

Q129: More Company has two divisions, L and