Mccance Corporation has an activity-based costing system with three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $28,000 for the Machining cost pool, $13,800 for the Setting Up cost pool, and $27,200 for the Other cost pool.

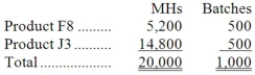

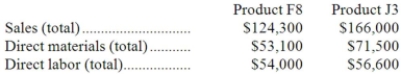

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

Definitions:

Jobholders

Individuals who are currently employed or possess a job.

Interviews

The process of assessing a candidate's suitability for a role, typically involving a conversation between the interviewer and the interviewee.

Employee Log

An approach to collecting job- and performance-related information by asking the jobholder to summarize tasks, activities, and challenges in a diary format.

Diary Format

A method of organizing information, observations, and thoughts on a daily basis, often used as a personal record.

Q13: The Dill and Gherkin Law Firm is

Q20: How many units would the company have

Q28: The combined present value of the working

Q29: Crinks Corporation uses direct labor-hours in its

Q45: A total of 30,000 units were sold

Q47: The unit product cost under absorption costing

Q87: Qu Company, which has only one product,

Q137: Fjeld Corporation produces and sells two products.

Q139: The profitability index of investment project S

Q175: Rider Company sells a single product. The