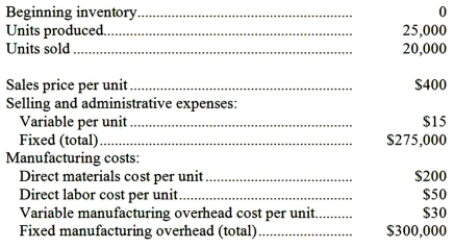

The EG Company produces and sells one product. The following data refer to the year just completed:  Assume that direct labor is a variable cost.

Assume that direct labor is a variable cost.

Required:

a. Compute the cost of a single unit of product under both the absorption costing and variable costing approaches.

b. Prepare an income statement for the year using absorption costing.

c. Prepare a contribution format income statement for the year using variable costing.

d. Reconcile the absorption costing and variable costing net operating income figures in (b) and (c) above.

Definitions:

Physical Therapy

A specialized form of healthcare that uses physical methods, such as exercise and massage, to treat injuries or disorders and improve movement and function.

Respiratory Therapy

Medical care specializing in the treatment, management, control, and care of patients' breathing and those with lung disorders.

Impaired Physical Mobility

A reduction in the ability to move freely and easily, often due to injury, disease, or a physical condition.

Left Shoulder

Referring to the part of the human body where the arm joins the torso on the left side, often associated with various structures like muscles, bones, and joints.

Q1: What would be the total overhead cost

Q17: If the new product is added next

Q35: Bertone Inc., which produces a single product,

Q55: Evans Company produces a single product. During

Q61: If the company desires a net operating

Q99: The use of predetermined overhead rates in

Q121: The unit sales to attain that the

Q130: The contribution margin per unit would be:<br>A)$12.10<br>B)$22.10<br>C)$17.70<br>D)$16.60

Q158: Colasuonno Corporation has two divisions: the West

Q221: Turner Company's contribution margin ratio is 15%.