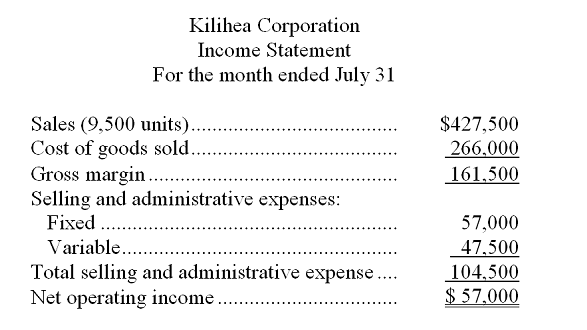

Kilihea Corporation produces a single product. The company's absorption costing income statement for July follows:  The company's variable production costs are $20 per unit and its fixed manufacturing overhead totals $80,000 per month.

The company's variable production costs are $20 per unit and its fixed manufacturing overhead totals $80,000 per month.

-The contribution margin per unit during July was:

Definitions:

Taxes

Compulsory financial charges imposed by a government on individuals and organizations to fund public expenditures.

Disposable Income

Money left after taxes and social security contributions have been subtracted, which can be either spent or saved according to personal preference.

Aggregate Spending

The total spending in an economy, including consumption, investment, government expenditures, and net exports.

Discretionary Fiscal Policy

The deliberate manipulation of government purchases, taxation, and transfer payments to promote macroeconomic goals, such as full employment, price stability, and economic growth

Q10: In least-squares regression, independent variables are not

Q15: Currey Inc., which uses job-order costing,

Q21: When analyzing a mixed cost, you should

Q33: Variable manufacturing overhead costs are treated as

Q38: The company's contribution margin ratio is closest

Q42: The predetermined overhead rate was based on

Q55: Evans Company produces a single product. During

Q92: What is the unit product cost for

Q127: What is the unit product cost for

Q143: Data concerning Lantieri Corporation's single product appear