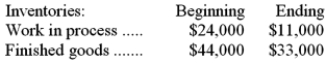

Burghardt Inc. uses a job-order costing system in which any underapplied or overapplied overhead is closed out to cost of goods sold at the end of the month. The company's cost of goods manufactured for January was $249,000 and its beginning and ending inventories were:  During the month, the manufacturing overhead cost incurred was $79,000 and the manufacturing overhead cost applied was $80,000. The cost of goods sold that appears on the income statement for January and that has been adjusted for any underapplied or overapplied overhead is closest to:

During the month, the manufacturing overhead cost incurred was $79,000 and the manufacturing overhead cost applied was $80,000. The cost of goods sold that appears on the income statement for January and that has been adjusted for any underapplied or overapplied overhead is closest to:

Definitions:

Income Taxes

Taxes on an individual's or corporation's income imposed by the government.

Modified Accelerated Cost Recovery System (MACRS)

The system of accelerated depreciation allowed for federal tax computations.

5-Year Asset

An asset that is expected to provide economic value or service for a period of five years.

Computers

Electronic devices designed to process, store, and communicate information, playing a crucial role in both personal and professional settings.

Q23: To the nearest whole cent, what should

Q37: When reconciling variable costing and absorption costing

Q51: At an activity level of 9,200 machine-hours

Q74: The unit contribution margin is:<br>A)$17<br>B)$8<br>C)$1<br>D)$9

Q82: The IT Corporation produces and markets two

Q89: The total of the product costs listed

Q116: Roy Corporation produces a single product. During

Q146: Which of the following costs would not

Q175: Sproles Inc. manufactures a variety of products.

Q182: The unit product cost under absorption costing