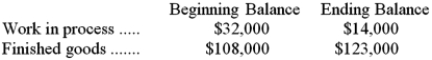

Babb Company is a manufacturing firm that uses job-order costing. The company's inventory balances were as follows at the beginning and end of the year:  The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 17,000 machine-hours and incur $272,000 in manufacturing overhead cost. The following transactions were recorded for the year:

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 17,000 machine-hours and incur $272,000 in manufacturing overhead cost. The following transactions were recorded for the year:

• Raw materials were requisitioned for use in production, $412,000 ($376,000 direct and $36,000 indirect).

• The following employee costs were incurred: direct labor, $330,000; indirect labor, $69,000; and administrative salaries, $157,000.

• Selling costs, $113,000.

• Factory utility costs, $29,000.

• Depreciation for the year was $121,000 of which $114,000 is related to factory operations and $7,000 is related to selling, general, and administrative activities.

• Manufacturing overhead was applied to jobs. The actual level of activity for the year was 15,000 machine-hours.

• Sales for the year totaled $1,282,000.

Required:

a. Prepare a schedule of cost of goods manufactured in good form.

b. Was the overhead underapplied or overapplied? By how much?

c. Prepare an income statement for the year in good form. The company closes any underapplied or overapplied overhead to Cost of Goods Sold.

Definitions:

Minority Active Investment

An investment where the investor holds a non-controlling interest in a company but is still actively involved in its management or operations.

Equity Method

An accounting technique used for recording investments in associate companies where the investment is initially recognized and subsequently adjusted for the investor’s share of the net assets of the investee, including recognized income or loss.

Cost Method

An accounting method used to record investments in which the investment is recorded at its acquisition cost without recognizing subsequent changes in market value.

Investment Method

A technique for recognizing the investor's share of investee profits and adjusting the carrying amount of the investment accordingly.

Q1: Using the least-squares regression method, the estimate

Q19: The company's overall contribution margin ratio for

Q29: The company's contribution margin ratio is closest

Q39: The following data have been provided by

Q48: What would be the average fixed maintenance

Q55: Elwood Inc. uses a job-order costing system

Q68: The activity rate for the Machining activity

Q93: The carrying value on the balance sheet

Q96: The amount of direct materials cost in

Q138: Perona Corporation produces and sells a single