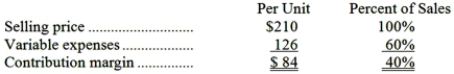

Data concerning Goulbourne Corporation's single product appear below:  Fixed expenses are $444,000 per month. The company is currently selling 7,000 units per month.

Fixed expenses are $444,000 per month. The company is currently selling 7,000 units per month.

Required:

Management is considering using a new component that would increase the unit variable cost by $2. Since the new component would improve the company's product, the marketing manager predicts that monthly sales would increase by 200 units. What should be the overall effect on the company's monthly net operating income of this change if fixed expenses are unaffected? Show your work!

Definitions:

Unanticipated Inflation

Inflation that occurs when the actual rate is not what was expected, causing uncertainty and potential issues for businesses and consumers.

Nominal Interest Rate

The rate of interest charged on loans or paid on savings before adjusting for inflation, reflecting the face value rate.

Real Interest Rate

The interest rate adjusted for inflation, representing the true cost of borrowing or the true return on savings.

Anticipated Inflation

The rate of inflation that consumers and firms expect in the future, often based on past inflation rates and current economic conditions.

Q11: Holding all other things constant, an increase

Q18: How many units of product I90J should

Q29: Holding all other things constant, an increase

Q36: The absorption costing approach to cost-plus pricing

Q54: Bill Pope has developed a new device

Q54: Yista Corporation uses a predetermined overhead rate

Q61: A value chain for an industry sets

Q83: The cash basis method of accounting can

Q90: The predetermined overhead rate for the year

Q225: This question is to be considered independently