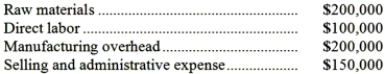

Butteco Corporation has provided the following cost data for last year when 100,000 units were produced and sold:  All costs are variable except for $100,000 of manufacturing overhead and $100,000 of selling and administrative expense. There are no beginning or ending inventories. If the selling price is $10 per unit, the net operating income from producing and selling 110,000 units would be:

All costs are variable except for $100,000 of manufacturing overhead and $100,000 of selling and administrative expense. There are no beginning or ending inventories. If the selling price is $10 per unit, the net operating income from producing and selling 110,000 units would be:

Definitions:

Incremental Costs

Incremental costs refer to the additional costs that a company incurs when increasing its production or activities by a small amount, also known as marginal costs.

Accumulated Depreciation

The total amount of depreciation expense recorded for an asset over its life.

Net Advantage

A term used in various contexts to indicate the superiority or benefit achieved by one option over another, often evaluated in decision-making scenarios.

Annual Operating Costs

The yearly expenses associated with running a business, excluding costs associated with the production of goods or services.

Q9: Perin Corporation would like to use target

Q10: Heiskell Corporation has provided the following data

Q27: The following monthly data are available for

Q31: The conversion cost for December was:<br>A)$107,000<br>B)$142,000<br>C)$111,000<br>D)$178,000

Q31: Ports Inc., which uses job-order costing, has

Q47: What is the overhead cost assigned to

Q95: Under variable costing, the unit product cost

Q137: How much cost, in total, should NOT

Q142: What is the total period cost for

Q194: Zeeb Corporation produces and sells a single